universal life insurance face amount

By extension the policyholder also determines the face amount of the policy. The price tag on universal life UL insurance is the minimum amount of a premium payment required to keep the policy.

Life Insurance Policy Loans Tax Rules And Risks

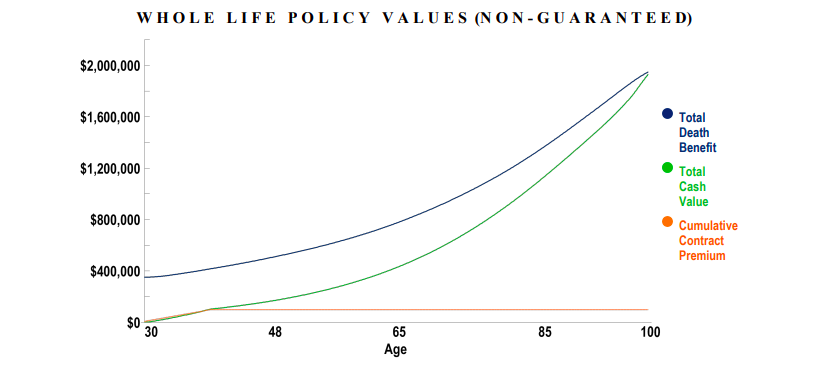

The amount of money that has accumulated is known as the cash value of the whole life policy.

. It allows for a greater degree of flexibility and often lower cost than whole life insurance another popular type of permanent insurance. Universal life insurance is a type of permanent life insurance. Face amount life insurance definition industrial life insurance face amounts face amount of policy face amount meaning life insurance face value what is face amount face amount vs cash value life insurance.

The policyholders flexibility extends to the amount of the monthly premiums paid as well as their frequency. In 2017 that number grew to about 163000. O True False.

Help protect your loved ones with valuable term coverage up to 150000. The face amount is the purchased amount at the beginning of a contract. Universal life has two basic death benefit options.

A permanent life insurance policy has a face value also known as the death benefit. Just Give a Minute Compares FREE Quotes Save up to 70. Almost Everybody Needs Life Insurance.

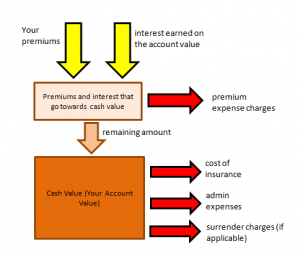

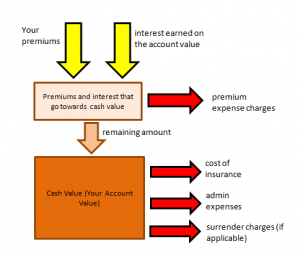

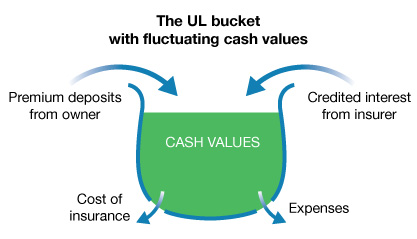

Under Universal life insurance the face amount of insurance can be increased with evidence of insurability. Ad Understand the Basics About Life Insurance and Why You Should Consider Life Insurance. Universal life insurance often shortened to UL is a type of cash value life insurance sold primarily in the United StatesUnder the terms of the policy the excess of premium payments above the current cost of insurance is credited to the cash value of the policy which is credited each month with interestThe policy is debited each month by a cost of insurance COI charge.

When a life insurance policy is identified by a dollar amount this amount is the face value. Variable universal life VUL is a type of permanent life insurance policy with a built-in savings component that allows for the investment. That means the policyholder decides how much to put in above a set minimum.

See your rate and apply now. Average life insurance face amounts have come down from a high point of 175000 in the mid 2000s. When you discuss how much life insurance you need youre considering which face value is right for you.

The face value or face amount of a life insurance policy is established when the policy is issued. A 500000 policy therefore has a face value of 500000. On the other hand another one is the amount collected by a beneficiary after the death of an insured person.

Only permanent life insurance policies such as whole life and universal life have a cash value account. But universal life insurance has an important difference from other types of permanent insurance. Ad Rates starting at 11 a month.

All life insurance policies have a face value. For over 35 Years SelectQuote Has Helped People Find The Right Insurance For Their Needs. According to Statista the average Face Amount of Life insurance purchased in the United States in 2015 was about 160000.

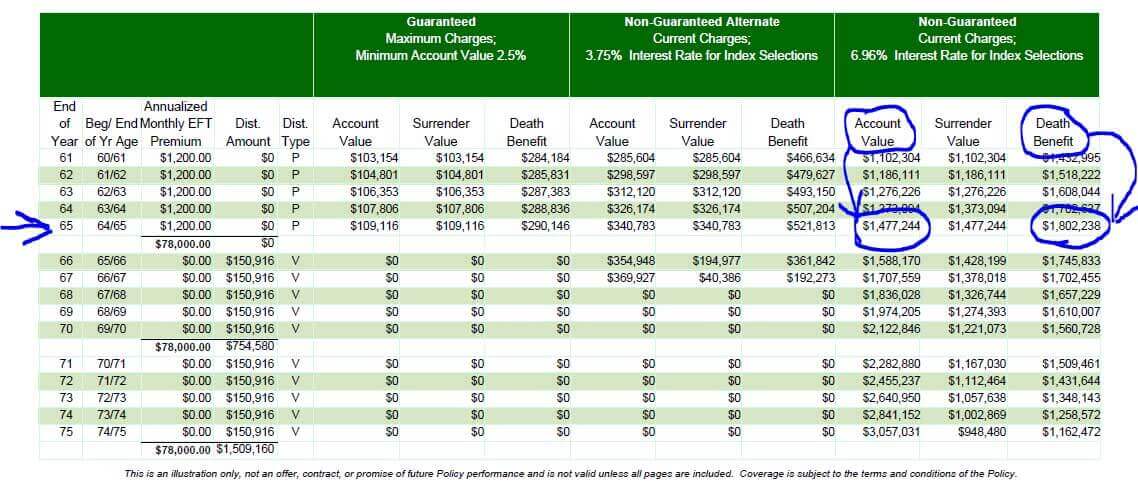

Option B is the face amount plus the cash value. In Option B more goes toward raising the death benefit through investing. Universal life has two basic death benefit options.

Option A is a level death benefit called the specified or face amount. However the face amount of insurance can be reduced with no evidence of insurability. The amount of money that your insurance provider puts toward the policy is known as the face value and is the amount that will be paid out to your.

Once the insured one passes away his beneficiaries will receive money. The face amount of a life insurance policy tells you how much it pays out to your loved ones or beneficiaries when you die. Universal life insurance policies accumulate cash value.

SelectQuote Rated 1 Term Life Sales Agency. There are no tax. Ad Shop The Best Rates From National Providers.

This is the dollar amount that the policy owners beneficiaries will receive upon the insureds death. Its the amount of death benefit purchased which indicates the amount of money the policy will pay to the beneficiary or beneficiaries when the insured person dies. It provides a flexible premium.

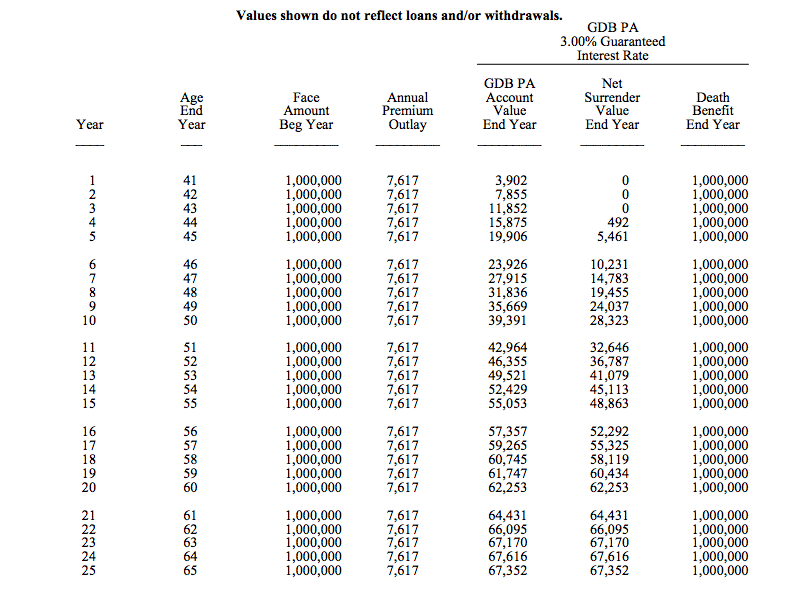

Under Universal life insurance the face amount of insurance can be increased with evidence of insurability. Explore the Combinations of Different Insurance Options That Fit Your Unique Needs. Using the 500000 face value and 100000 cash value example your beneficiary would get a total payout of 600000 if there arent any outstanding loans and interest.

In Option A more of your payment goes toward building the cash value. This option gives your beneficiary a greater financial advantage because he or she would receive both the face value and the cash value amount. Normally the face amount is a round number like 50000 or 100000.

Face Amount is the amount of life insurance that a policy owner purchases. Ad Confidently Know Youre Doing the Best for Your Family. Under the terms of the policy the excess of premium payments above the current cost of insurance is credited to the cash value of the policy which is credited each month with interest.

Life Insurance Face Amount - If you are looking for the best life insurance quotes then look no further than our convenient service. The actual death benefit paid on a death claim could differ from the face amount due to death benefit options policy riders loans interest on loans and withdrawals.

Life Insurance Loans A Risky Way To Bank On Yourself Life Insurance Life Insurance Quotes Life Insurance For Seniors

Universal Life Insurance Everything You Need To Know 2022

:max_bytes(150000):strip_icc()/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

Cash Value Vs Surrender Value What S The Difference

Independent Agent S Guide To Indexed Universal Life Insurace 2022

Limited Pay Whole Life Insurance What Is It See The Numbers

Cash Value And Cash Surrender Value Explained Life Insurance

The Risk Of Surviving To Policy Maturity What Trustees Need To Know Ric Omaha

Term Life Vs Universal Life Insurance

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

5 Disadvantages Of Indexed Universal Life Insurance Know Your Options

Understanding Universal Life Insurance Forbes Advisor

What Are Paid Up Additions Pua In Life Insurance

Top 10 Pros And Cons Of Variable Universal Life Insurance

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

Overfunded Cash Value Life Insurance Policy 2022 Update

Division Of Financial Regulation Universal Life Premium Life Insurance And Annuities State Of Oregon

![]()

Permanent Life Insurance Universal Life Vs Whole Life Vs Term 100 2022 Protect Your Wealth